The content of the financial promotions on this website has not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000. Reliance on these promotions for the purpose of engaging in investment activity may expose an individual to a risk. Please read the risk statement and Information Memorandum.

There are two features for investors who prefer a regular income and one for those who prefer capital growth.

*Captial at risk. Past perfomance is not a guide to future performance.

Your investment helps to fund the construction of sustainable family homes. Our developments are expertly appraised and evaluated aiming for competitive and achievable returns.

When reviewing a site, our team of construction professionals and independent experts analyse the costs vs Gross Development Value to determine the appropriate funding structure for a project. Our Funding is typically a mix of commercial loans from banks and individual investments. This style of funding is known as mezzanine financing – Beaufort equity makes up the balance.

Beauforts investment committee will evaluate how to structure mezzanine finance from beauforts investor portfolio. Our experts assess a range of commercial considerations, such as build schedules and funding elements to ensure we define the correct funding approach.

The investment committee’s objective is to ensure the rate of return and profits offered to mezzanine investors is both competitive and achievable. We review security types, such as redeemable shares or legal charge, the developments location and margins. Our open book policy ensures investors have the complete picture.

Our online platform allows investors to create an account and once our short compliance process is completed. Review and select a specific project to fund – Where you have all the development information. The account allows investors to see the developments funded, receive notifications and manage your investor profile.

Mezzanine funding that is raised for a development is allocated to a Special Purpose Vehicle (SPV) that is created for each project – a dedicated company that is formed to undertake the land purchase within Beauforts corporate structure.

Investors will receive fixed income returns. investors into a a project will also receive a profit participation return – once the project is completed.

‘Mezzanine’, or intermediate finance fills the gap between senior debt (usually bank loans) and equity in terms of the risk/reward profile for the lender.

A standard bank loan, which gives the lender first charge, or claims on the property in the case of default, presents the lowest risk and therefore offers the lowest returns. An equity investment in property carries a potentially higher risk and therefore offers the highest returns. Mezzanine finance sits between the senior debt and the developer’s equity and is routinely used in the housebuilding industry. It is an effective way to fund large projects when bank funding and the equity available do not cover the cost of the development. This enables housebuilders, such as Beaufort, to increase their development activities and build more homes.

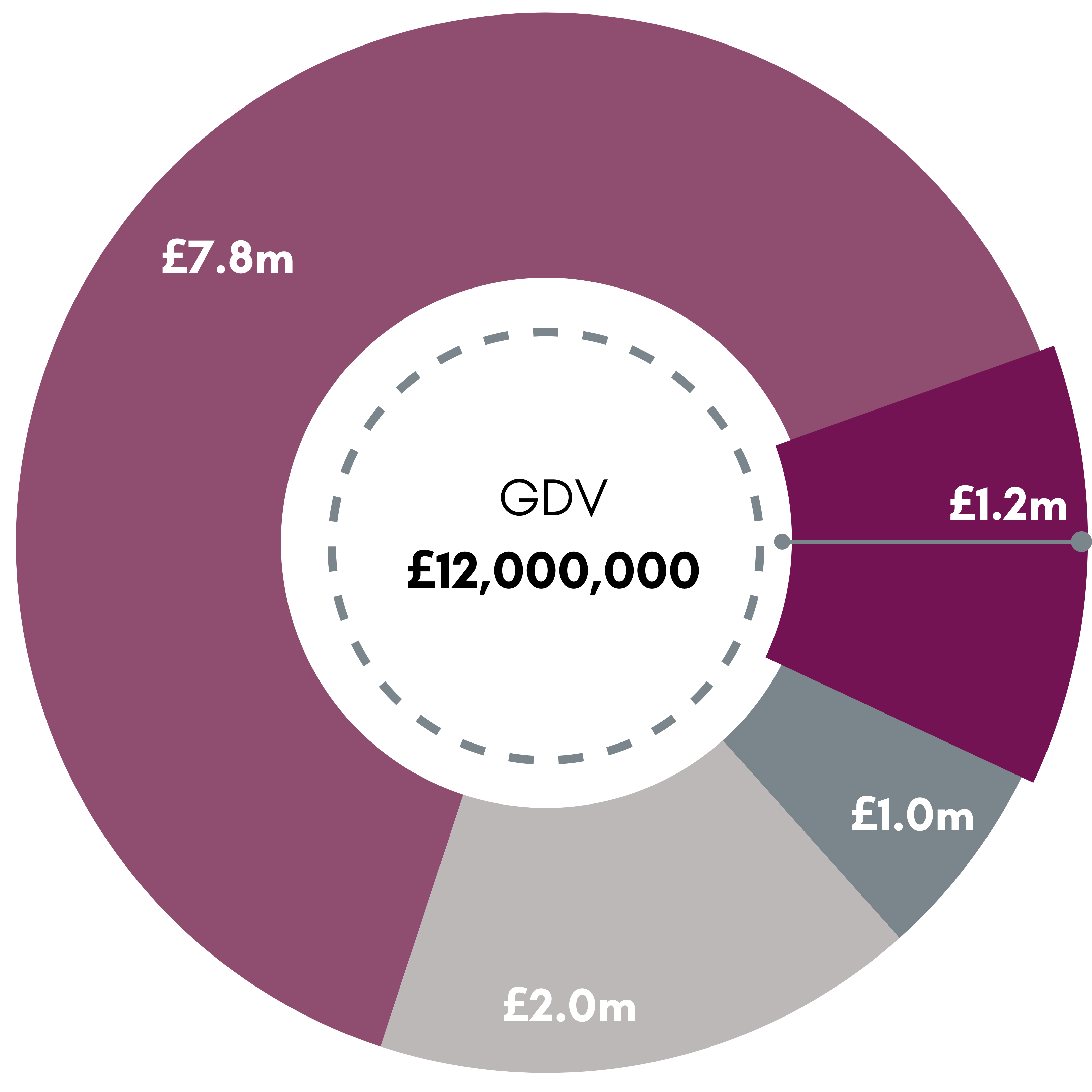

While funding requirements vary across projects, our approach is consistent and aims to grow your investment. Our funding structure is typically made up of standard bank funding, mezzanine funding and Beaufort’s equity. This example project costs £10m and has a Gross Development Value (GDV) of £12m. Beaufort would realise a profit of £2m or 20% of the cost – in line with industry standards.

Standard bank loans of £7.8m (65% of the GDV) – secured by a first legal charge on the property – would provide the bulk of the funding for the overall £10m costs.

Mezzanine funding would provide £1.2m (10% of the GDV).

Beaufort Property Group would invest the remaining £1m (8.3% of the GDV) in the form of equity.

The profit in the example – £2m – would be split between the three groups of investors as well as the original invested capital returned.

Now you can monitor your investment(s) online via our platform at www.beaufortpropertyinvest.com.

You will automatically receive a monthly, quarterly, bi-annual or end of term income, if that is your chosen option. Alternatively you will receive a lump sum on completion of the development project, including any profit participation component.

Returns are not guaranteed and past performance is not an indicator of future performance.

Complete self-certification to confirm that you are either a High Net Worth Individual, a certified sophisticated investor or a self-certified sophisticated investor.

Complete self-certification to confirm that you are either a High Net Worth Individual, a certified sophisticated investor or a self-certified sophisticated investor.

Complete self-certification to confirm that you are either a High Net Worth Individual, a certified sophisticated investor or a self-certified sophisticated investor.

Complete self-certification to confirm that you are either a High Net Worth Individual, a certified sophisticated investor or a self-certified sophisticated investor.

Beaufort Property Invest is an England and Wales Registered Company No: 12169000

To view the content, you must be either: (a) High Net Worth Individual or (b) Self-Certified Sophisticated Investor. If you do not meet these criteria, you must not take any further action. This website assumes you have a clear understanding of investments of this type and is provided to prospective investors to evaluate the investment being offered. Before you will be able to view the offering, you must certify your investor status.

© 2025 copyright Beaufort Property Invest Ltd.

Design by – DSTechnology